Valuation Surveys

Bruce includes free complimentary Valuation data with his offer and the following complimentary valuation data with his unique Combined Structural, Building & Home Survey:

- Price per M2 and Ft2 and average comparable price per M2 and Ft2 in area

- Similar properties sold in area over last 18 months

- Date and price when property was last sold

- Average capital growth in area over last 5 years

- Build Cost Calculation

- Average Yield for similar property

- Flood Risk

- Internet speed

- Local Authority rate for similar property

- Area description

What is the value of a Residential Dwelling House?

It is worth what a person will pay who has full knowledge of;

- The structure and condition of the property and the cost, if necessary, to bring it into a sound structural condition with modern desirable services, layout and décor.

- The relationship between supply, demand and cost

- All Risk Yield (what the property will provide in rental pa minus all associated costs)

- The length of time it takes to sell (release the equity)

- It’s capital growth per annum

- Peak, trough and median analysis of the established value and its capital growth per annum (ie in London sell when others are greedy, buy when others are fearful – different rules apply in the different property markets)

Utilising the above there are two main methods of determining value:

- Investment: Properties can be rented which is a common method of capital The higher the rent per annum the higher the capital value and conversely the lower the rent per annum the lower the value. The per annum requirement allows for the vagaries of seasonal fluctuations ie seaside properties in latitudes with limited summers.

- Comparables: It is common for people who do not have the full knowledge as above to compare a property which has recently sold with the property under scrutiny – same location, type, condition, time – this is utilising the skills used to buy for example a pint of beer, a loaf of bread, a car etc. Comparables are a useful rule of thumb and the following websites will assist and indeed may suffice:

- https://www.rightmove.co.uk/house-prices.html

- https://www.findproperly.co.uk/

- Aberration: Rarely a buyer will aberrantly purchase; such aberrant behaviour should not be relied upon to determine value.

Once a buyer has made an offer on a property they will generally wish to enter into negotiations with the seller (often called the vendor). The purpose of negotiations is to secure the property for a more realistic price than is being requested. The buyer should enter into the negotiations initially as a friend as at that stage there is nothing to gain from a different approach. The buyer should explain that their Chartered Consultancy has advised them that the property requires x amount of works and or is overpriced, that they love the property but they have stretched themselves to their limits but are prepared to move forward without further hesitation if the vendor can reduce the price to the determined realistic price. From the vendor’s reaction to the buyers opening negotiation the following can be determined:

- Whether or not the vendor needs to sell the property forthwith (ie if they will lose the property they wish to buy, they have financial difficulties, it is a buyer’s market etc) – in this case they will make a counter offer

- Whether or not the vendor is in this for the long haul and they don’t need to sell in the short term – in this case they will reject the offer

- The vendor has other interested buyers, it is a seller’s market – in this case they will play for time by suggesting the Chartered Consultancy is possibly incorrect etc and that his report be substantiated by Building Control completion certificates, Party wall awards, planning consents etc

And from the above the buyer can make their determinations.

Some mathematical derivations follow from the above:

Structure and condition: The property requires 100k worth of work; it is therefore worth 100k less than an identical property which does not.

No Building Control Completion Certificates, Planning permissions etc: If these are required and are not in place, the buyer should immediately presume that they do not exist and should waste no more time and allow the cost of regularisation

Capital Growth: Multiply the previous sale price of the property by the multiplier to find the current value – 1.07 to the power of 20 = 3.87 * ie 350000 = 1.354m

Determine multiplier by:

- Adding %growth to 1 (ie 1.07)

- Raise to the power of the number of years growth (when the property was last sold) (ie 20)

Percentage Growth: Divide initial value by current value and take the time root of the result (reverse of the above)

Investment: Rental income = x% of Market Value (yield)

Divide the value of the property by the yearly rental income and you achieve a yield (add/add by quantification all overheads, maintenance and repair, possible outgoings, reliability of tenant, demand, risk of voids etc and you have an all risk yield).

Therefore: Capital Value = (Annual Rental Income / Yield) x 100

The rental income (yield) will be by demand. Currently in London the yield is around 3% which gives a 33 multiplier for value – the yield is determined by demand for such investments throughout the leading world property markets.

ie rental 30k per year, yield 3%, multiplier 33 value = 30k*30 = 900k

Never forget or loose track of the fact that London prices have historically risen by 7-10% over the last 100 years – they double every 10-7 years (respectively) – you double your money every 7-10 years and get a rental and the lower the yield the less risk involved – it’s as safe as houses!

Investment return in extremis: In extremis (for example renting in remote areas) yield is minimised around 10% which gives a multiplier of 10 although it is recommended an allowance of up to 15% yield be allowed which would give a multiplier of between 10 and 6. There are some entrepreneurs who are skillfully able to produce a much higher yield especially for attractive shorefront properties etc however these properties are generally only rented for a maximum of 6 months of the year and will only reap the highest rental for 2 months of those 6

Ie rental 20k per year, yield 12.5%, multiplier 8, value = 20k*8 = 160k

The astute reader will have quickly notices the relationship between yield and the multiplier can be simply remembered as follows:

1 :100

2 : 50

3 : 33

4 : 25

5 : 20

6 :15.5

7 :14.3

8 :12.5

9 :11.1

10 :10

ie the fraction of 100 divided by the multiplier

The two extremes of property value: at one extreme the property is a financial asset which increases in value every year and gives a rental return higher than any other world investment which further increases its value as investors will seek out and pay a premium for such an investment; it is a world class investment (which can also serves as a home). At the other extreme it is unfortunately a trap which can only be escaped from by at best a loss or at worst walking away and these choices are only available to those with money available.

Worse Scenarios: The property last sold for more than is being asked for now, it is a diminishing asset and has no investable growth and therefore you will be unable to sell the property in the future. This is often the case in areas which have declined, are in decline, which require re-generation or are dependent on government funding – these properties often require expensive repair and renovation.

Equity release: your asset will diminish if your capital appreciation is less than the interest charged and in time your property will have no worth to you or your beneficiaries.

Selling your London home to release equity for retirement: If you purchase a property which does not increase in value you will not be able to sell it/release the equity in it if you need to go into care.

How to fully protect your interests: Ensure you have the protection of the professional indemnity insurance of a valuation surveyor (and ensure they have full professional indemnity insurance in place). Case law allows the valuation surveyor 15% deviation and if they fail in their duty of care you can rely on damages to put you in a position where you were before the loss occurred.

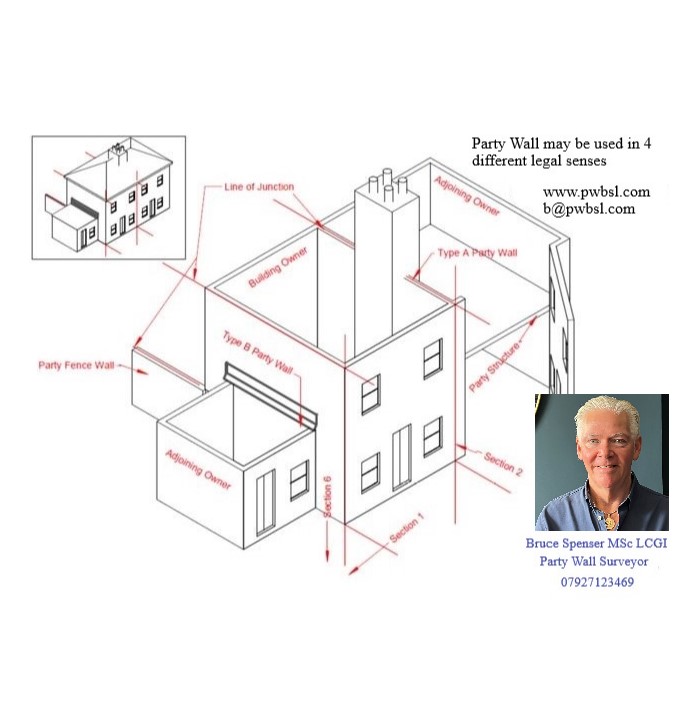

Party Wall Surveyor serving Thanet and London

Third Surveyor serving England and Wales